A deep dive into the definitive hospitality industry trends 2025. This expert report analyzes market forecasts, AI-driven guest experience, sustainable practices, and food and beverage trends in hospitality industry to provide a strategic outlook.

Navigating the Macroeconomic and Market Landscape: Cautious Optimism Amidst Headwinds

The year 2025 represents a period of significant strategic recalibration for the hospitality sector. While the global economy faces ongoing headwinds, the industry is demonstrating resilience, with success hinging on the ability to adapt to a bifurcated market and leverage technology for operational efficiency and enhanced guest value. The macroeconomic outlook is defined by a slowing pace of growth, but beneath the surface, there are nuanced opportunities for properties that align their strategies with evolving consumer behaviors and investment priorities.

The 2025 Economic Outlook: A Slowing Pace with Nuanced Opportunities

The macroeconomic environment for 2025 is characterized by cautious optimism, with an uncertain tariff environment, elevated interest rates, and geopolitical uncertainties shaping the landscape.1 The analysis from PwC forecasts a significant deceleration in U.S. GDP growth to 0.7% on a fourth-quarter-over-fourth-quarter basis, a notable drop from the 2.5% growth observed in 2024.1 Inflation is anticipated to rise to 2.7% in 2025, a steady but still high rate that is expected to significantly influence consumer behavior, particularly within the lower-priced hotel segments.1

As a result of these factors, RevPAR (Revenue Per Available Room) growth is expected to slow considerably. PwC forecasts a 0.8% increase, while CBRE projects a slightly higher 2% growth in U.S. RevPAR. This growth will be primarily driven by room rate gains rather than increases in occupancy.2, 3 Demand is expected to be uneven throughout the year, with a significant deceleration anticipated in Q2 2025, during which PwC expects RevPAR to decline by 1.2% year-over-year.

However, a positive momentum is anticipated to recommence in the second half of the year as the macroeconomic picture clarifies and the potential impacts of major fiscal policies are better absorbed.1 The slowdown in travel is already evident: domestic leisure travel growth has softened due to inflation concerns and declining consumer sentiment, while domestic corporate travel shows mixed results, with stable demand for premium offerings and group travel despite a decline in lower-tier demand.1

The Great Demand Bifurcation: The Outperformance of Luxury

A defining feature of the 2025 market is the continued bifurcation of hotel operating performance. Luxury hotels are significantly outperforming their economy counterparts, a trend that began in 2024. Year-to-date through April, luxury RevPAR grew by 7.1%, while economy hotels saw only a 0.9% increase over the same period last year.1 This trend is not a short-term anomaly but reflects a fundamental shift in consumer behavior. The PwC data explicitly states that inflation will “significantly influence consumer behavior, particularly impacting the lower-priced chain scale segments”.1 This points to a widening chasm in consumer spending habits, where a segment of the market is insulated from inflationary pressures and continues to prioritize high-value, unique experiences over budget-conscious stays.

This dynamic allows luxury and upper-upscale segments to maintain their pricing power and profitability, even as overall demand growth moderates. CBRE’s projections reinforce this, anticipating luxury and upper-upscale RevPAR to increase by 3.8% and 3.7%, respectively.4 This outperformance is also a global phenomenon, driven by an expected mid-single-digit percentage increase in inbound international travel, which tends to favor higher-priced properties.2 The implication for economy properties is a double squeeze: a decline in demand from price-sensitive consumers combined with limited ability to absorb rising costs for wages and food by raising rates.

A Resilient Investment Landscape

Despite the macroeconomic headwinds and slowing demand growth, the investment outlook for the hospitality sector remains bright. High interest rates and construction costs have resulted in a limited new lodging supply, which is reverting to its long-term average of approximately 2.0%.1

This scarcity of new development is increasing the value of existing hotel assets.2, 4 Investor confidence is high, with a record number of first-time hotel buyers and 52% of investors surveyed expecting to increase their capital allocation to the sector in 2025.4 The environment, characterized by maturing loans and a narrowing gap between buyer and seller valuations, is predicted to drive a significant increase in transaction volumes over the next 18 months.4 This strategic window is an ideal time for well-capitalized investors to acquire existing, well-performing assets at potentially more favorable valuations, positioning themselves for the anticipated rebound in the latter half of the year.

Table 1: 2025 U.S. Market Performance Forecasts

| Indicator | PwC Forecast | CBRE Forecast |

| GDP Growth | 0.7% | – |

| Inflation | 2.7% | – |

| RevPAR Growth | 0.8% | 2.0% |

| RevPAR Q2 | -1.2% YoY | – |

| Supply Growth | ~2.0% | – |

| Luxury RevPAR | 7.1% YTD | 3.8% |

| Economy RevPAR | 0.9% YTD | – |

The New Guest Experience: Hyper-Personalization and the Power of Data

The Demand for a Tailored Stay

The modern traveler no longer seeks a one-size-fits-all experience; they expect a stay that feels uniquely tailored to their preferences. Data shows that 71% of consumers expect personalized service that reflects their individual preferences, from room setup to dining choices.5 This is more than a fleeting preference; it is a critical driver of guest loyalty. Studies indicate that 57% of consumers feel more loyal to brands that provide personalized experiences, and three-quarters are more likely to book with properties that cater to their needs.5

This demand for a bespoke experience is also reflected in the J.D. Power 2025 North America Hotel Guest Satisfaction Index Study, which found that guests’ perception of value is directly linked to investments in amenities like in-room smart TVs, which 40% of guests now consider a “need to have” amenity.6

The Technology Driving Personalization

Hyper-personalization is made possible through the strategic application of technology and data. AI and machine learning are pivotal, analyzing guest preferences, browsing history, and past stays to create tailored offers and experiences from the very first click.5, 7, 8, 9 This begins at the booking stage, where AI-driven website content adapts dynamically to the user.

Mobile apps are also a critical touchpoint, enabling digital keys, streamlined check-in and check-out, and providing on-demand information, which results in a satisfaction score that is 68 points higher for users compared to non-users.6, 10 The seamless experience continues in the guest room, where voice-activated controls, smart thermostats, and apps that suggest local activities make stays more tailored and memorable.7 This technological integration not only enhances guest satisfaction but also turns one-time visitors into repeat customers through thoughtful, personalized post-stay communication.7

The Rise of “Hospitality Retailing”

In response to heightened competition and evolving guest expectations, hotels are increasingly adopting a retail-oriented mindset to expand their revenue streams beyond traditional room bookings.5 This trend is a direct response to guest demand, with 75% of travelers interested in more personalized hotel experiences and nearly 60% willing to pay extra for additional amenities and unique services.5

By thinking like retailers and offering services like spa packages, local tours, and wellness activities to both guests and non-guests, properties embracing this model have seen up to a 25% increase in ancillary revenue.5

This hyper-personalization strategy is not merely a guest-facing amenity; it is a data-driven approach that directly impacts the bottom line. Technology enables personalization, which drives satisfaction and loyalty, which in turn leads to increased revenue through higher booking rates and ancillary spending. The adoption of technologies like flexible “Buy Now, Pay Later” (BNPL) payment options, which are popular among Gen Z travelers, can also increase average booking values by 48%.5

Similarly, the use of AI-driven concierge bots is a dual-purpose strategy that benefits both cost reduction and revenue growth. These bots provide 24/7 support, meeting the expectations of 51% of consumers for round-the-clock availability, while simultaneously reducing customer service costs by 20-40% and driving revenue through higher upsell conversion rates.5

Table 2: Technology & Its Dual Impact

| Technology | Impact on Guest Experience | Impact on Business Operations |

| AI Chatbots | 24/7 instant support; personalized interactions | 20-40% reduction in customer service costs; higher upsell conversion rates |

| Mobile Apps | Seamless check-in/out; digital keys; on-demand info | 68-point higher satisfaction score; increased revenue via tailored upsells |

| Smart HVAC | Personalized temperature control | Measurable energy cost reduction; strengthens eco-friendly brand image |

| Flexible Payments | Accessibility to premium upgrades; convenience | 48% rise in average booking values; builds guest loyalty |

Rating Trends for Hotels: What Truly Drives Guest Satisfaction

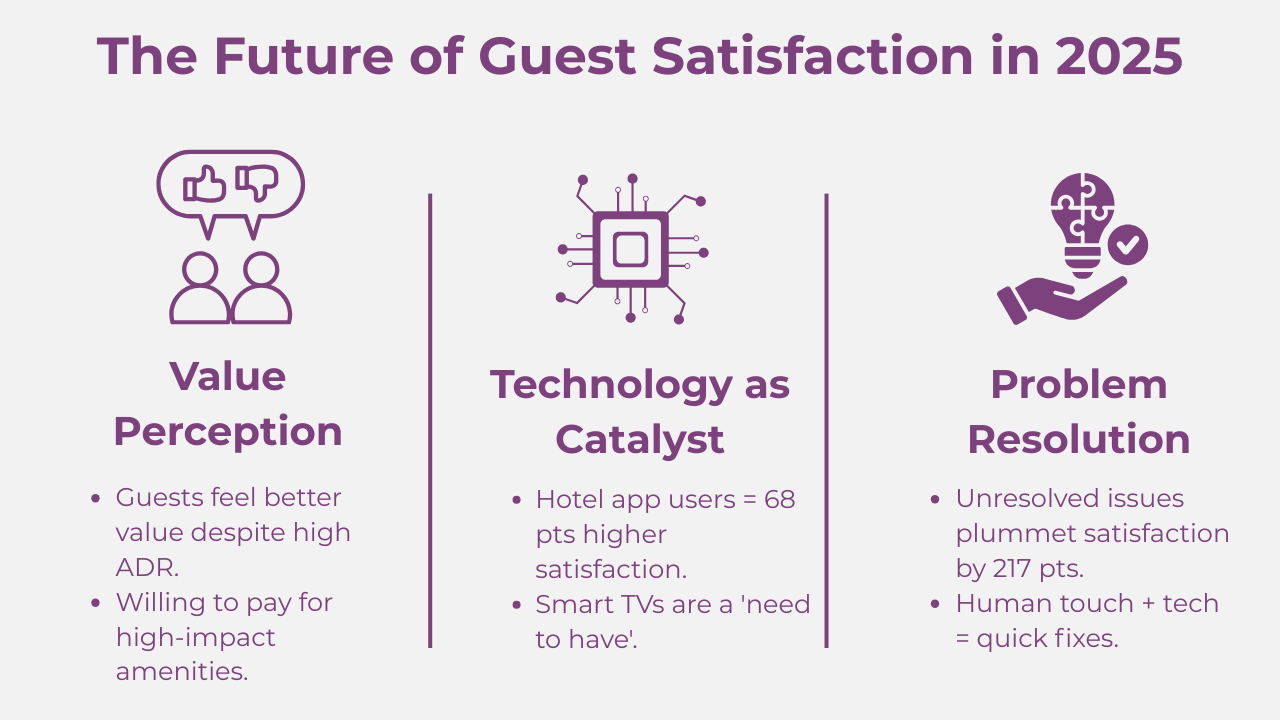

The Surprising Perception of Value

Despite the average daily rate (ADR) for a U.S. hotel room climbing to a record high of $158.67 in 2024, the J.D. Power 2025 North America Hotel Guest Satisfaction Index Study reveals a surprising finding: guests in every segment feel they are getting better value for their money.6

The key drivers for this improved perception are not low prices but rather strategic capital investments in guest rooms, including updated furnishings, bathroom fixtures, and bed comfort.6 The finding proves that guests are willing to pay a premium for a high-quality experience, reinforcing the outperformance of luxury and upscale segments.

Technology as a Satisfaction Catalyst

The J.D. Power study highlights two critical technological amenities that significantly impact guest satisfaction. First, 40% of guests now consider an in-room smart TV a “need to have” amenity, a nearly 100% increase from 2019, reflecting the guest’s desire for the “comforts of home”.6 Second, guests who use their hotel’s mobile app have an overall satisfaction score of 699, which is a remarkable 68 points higher than those who do not, showcasing the critical role of technology in providing a seamless, on-demand experience.6

The Critical Impact of Problem Resolution

While problems are rare, occurring in only 12% of stays, their impact on guest satisfaction is catastrophic. An unresolved issue can cause a satisfaction score to plummet by 217 points, from 677 to 460.6, 14 This finding highlights a crucial operational challenge: while technology can enable a frictionless experience, it cannot fully replace the human element of problem-solving.

The solution lies in a symbiotic relationship between technology and staff, with digital tools such as AI chatbots and unified desktops enabling staff to resolve issues quickly and efficiently, regardless of the guest’s location.14

Table 3: The Guest Satisfaction Equation

| Dimension of Satisfaction | J.D. Power Finding | Implication |

| Perception of Value | Guests feel better value despite record-high ADR | Guests are willing to pay a premium for high-impact amenities and strategic investments. |

| Technology Usage | Hotel app users score 68 points higher in satisfaction | Technology is a critical catalyst for a seamless and convenient experience. |

| Problem Resolution | Satisfaction plummets by 217 points when a problem occurs | Quick, efficient problem resolution is non-negotiable for preserving guest loyalty. |

The future of hospitality is not just about understanding these trends, but actively implementing solutions that bring them to life. This is where innovative technologies play a crucial role.

Elevate Your Guest Experience with Call The Service

As the hospitality industry looks to 2025, technology remains the most powerful tool for elevating the guest experience. While AI-driven personalization and immersive dining are on the horizon, platforms like Call The Service (CTS) are making these innovations a reality today. CTS is an all-in-one restaurant order management app designed to streamline operations, enhance guest satisfaction, and boost revenue.

How Call The Service is Shaping the Future

CTS integrates seamlessly into modern restaurant operations, addressing several key trends we’ve identified for 2025:

- Hyper-Personalization & Digital Menus: CTS’s Digital Guest Page & Customization feature allows restaurants to create unlimited, branded digital menus accessible via QR code. This empowers guests with real-time updates, detailed allergen information, and personalized promotions, aligning perfectly with the trend of tailored guest experiences.

- Efficiency & Staff Performance: The app’s Table & Staff Management with Guest Call and Efficiency Monitoring Dashboard directly tackle the need for streamlined operations. By organizing floor plans and tracking key metrics like response times and peak hours, CTS helps minimize waste and optimize staff performance. The AI-Generated Images feature also saves significant time and cost, directly contributing to operational efficiency.

- Enhanced Guest Satisfaction: The Guest Rating Function allows for real-time feedback, enabling continuous improvement and building trust. Combined with the Waiter Call and Order Requests feature, CTS ensures faster, more accurate service—a critical factor in driving positive rating trends for hotels and restaurants.

By adopting an innovative platform like Call The Service, businesses can not only keep pace with the evolving industry but also unlock new opportunities to generate more revenue by delivering the high-quality, efficient service that modern guests demand.

Conclusion: The Symbiotic Future of Hospitality

The definitive hospitality industry trends 2025 reveal a sector in the midst of a profound transformation, moving beyond simple service provision to a model of strategic, value-driven experience creation. The most successful hospitality businesses will master the symbiosis of three key pillars.

First, they will demonstrate strategic adaptability by navigating a nuanced and bifurcated market, focusing on delivering value-driven experiences that appeal to the segments with the greatest purchasing power. Second, they will view technology not merely as a convenience but as a strategic asset.

The data shows that technological investments are a core driver of personalization, operational efficiency, and new revenue streams, from AI-driven upsells to automated cost reductions. Finally, they will embrace a model of human-centered innovation. The J.D. Power findings make it clear that while technology can manage a majority of guest interactions, the human element remains vital, particularly for high-stakes problem resolution.

The future of hospitality is not about replacing humans with robots but about empowering staff with the data and tools necessary to deliver on the most critical part of hospitality: human connection and truly memorable experiences that drive long-term loyalty and profitability.